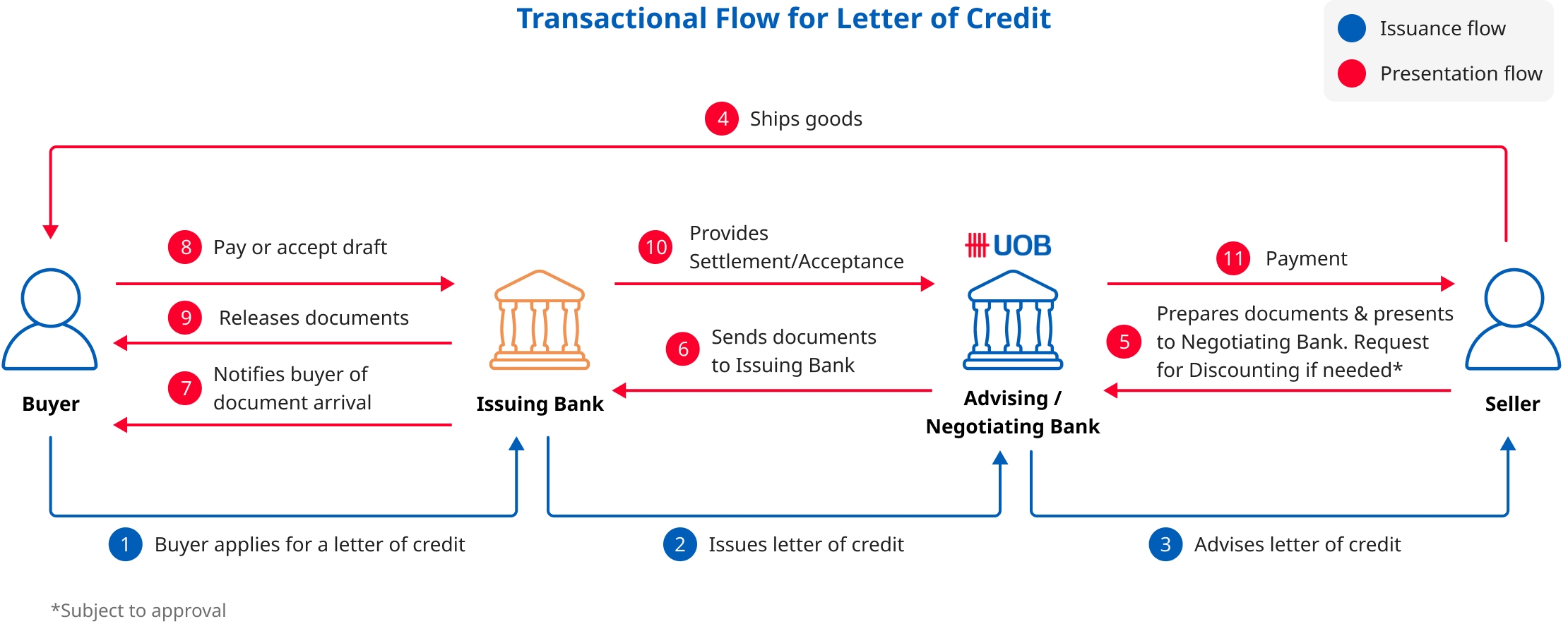

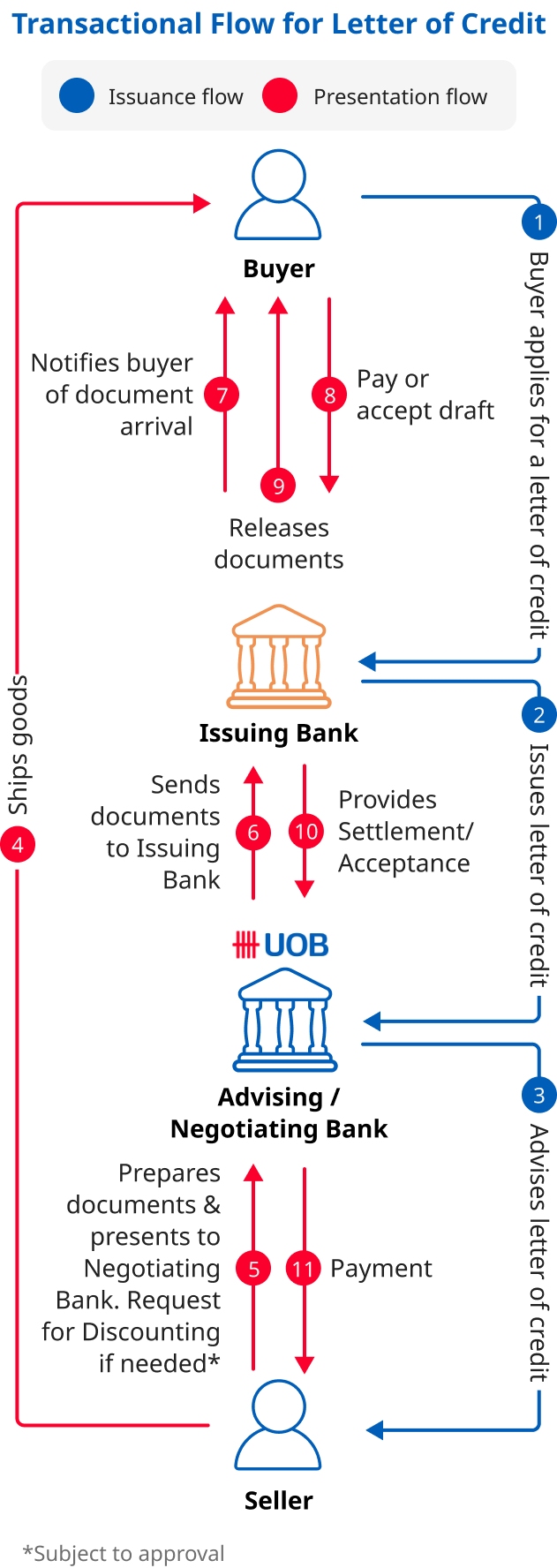

How does an Export Letter of Credit work?

Advising and Confirmation

UOB will notify you upon receipt of Letter of Credit (LC) from the Issuing Bank. If confirmation is added, UOB will pay upon compliance with LC terms.

Document Presentation & Negotiation

Seller ships goods and presents documents to UOB for handling and negotiation.

Payment & Settlement

UOB presents documents to Issuing Bank for payment according to terms of the LC. Discounting can be arranged, subject to approval.

Frequently asked questions

Who are the parties involved in a Letter of Credit?

Applicant

- The Applicant is typically the buyer and the party that initiates the request to the Issuing Bank to issue an LC on its behalf.

Beneficiary

- The Beneficiary is typically the seller and the party who will receive payment if it fulfils all the terms and conditions of the LC.

Issuing Bank

- The Issuing Bank is the Bank that issues the LC in favour of the seller, at the request of the buyer/applicant.

- By issuing an LC, the Issuing Bank undertakes to pay the beneficiary if all the terms and conditions of the LC are complied with.

Advising Bank

- The Advising Bank authenticates the LC received from the Issuing Bank and advises/notifies the Beneficiary that there is an LC issued in his favour.

Confirming Bank

- A Confirming Bank (normally also the Advising Bank) is the bank that adds its own undertaking to pay the LC beneficiary if all terms and conditions of the LC are complied with. Such undertaking is in addition to that given by the Issuing Bank.

- Confirmation is added only upon satisfactory evaluation on the Issuing Bank and its domicile country.

Negotiating Bank

- A Negotiating Bank is the bank that examines the drafts and/or documents presented by the LC beneficiary and gives values to such drafts and/or documents.