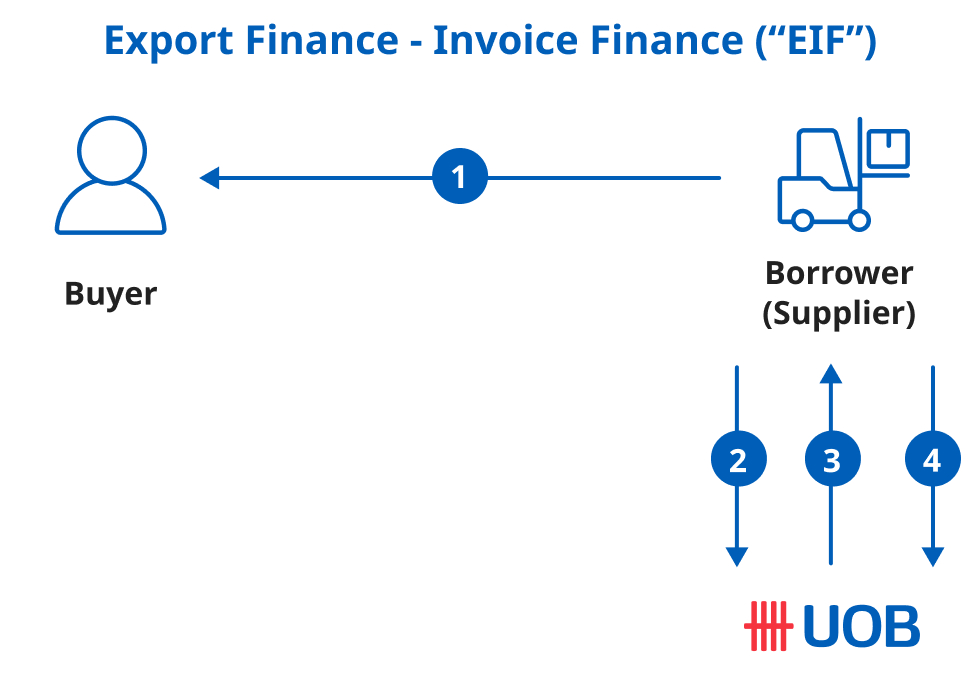

How does invoice financing work?

Import Finance - Invoice Finance.

- Buyer sends Purchase Order to Supplier for purchase of goods.

- Supplier ships goods and forwards the invoice(s) requesting for payment.

- Buyer submits financing application form, contract/PO, invoices and transport documents to UOB

- UOB makes payment on behalf of Buyer to Supplier

- On financing due date, UOB debits Buyer’s account at UOB for settlement..

Fees

For fees related to Trade Services, remittance fees and other service fees, please contact your nearest UOB China branch or you can call UOB China at 400 886 2821.

Click here to view Wholesale Banking Cash Management and Trade Finance Service Tariff.

UOB Infinity Trade

Apply for Invoice Finance for both imports and exports on UOB Infinity Trade Platform

Step one

Log in via UOB Infinity.

Step two

Select Trade Services.

Frequently asked questions

Where can I submit my Invoice Financing application form?

You may submit your application at any of our Branches. Click here to find the Branch nearest to you.

What are the required supporting documents for invoice financing application?

- Application form

- Contract/PO, invoice and transport document

- An import invoice financing facility granted by the Bank

- Proceeds of the import finance will be paid to the exporter as entrusted payment