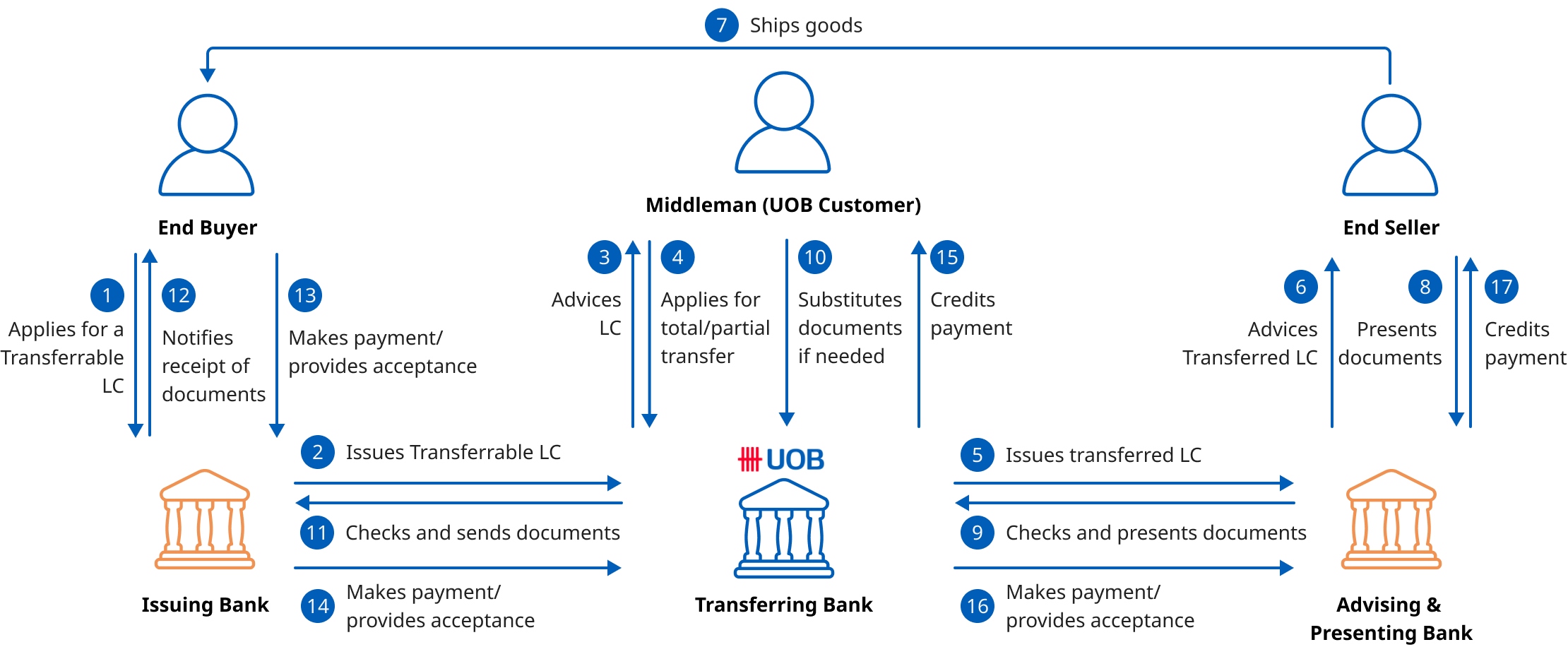

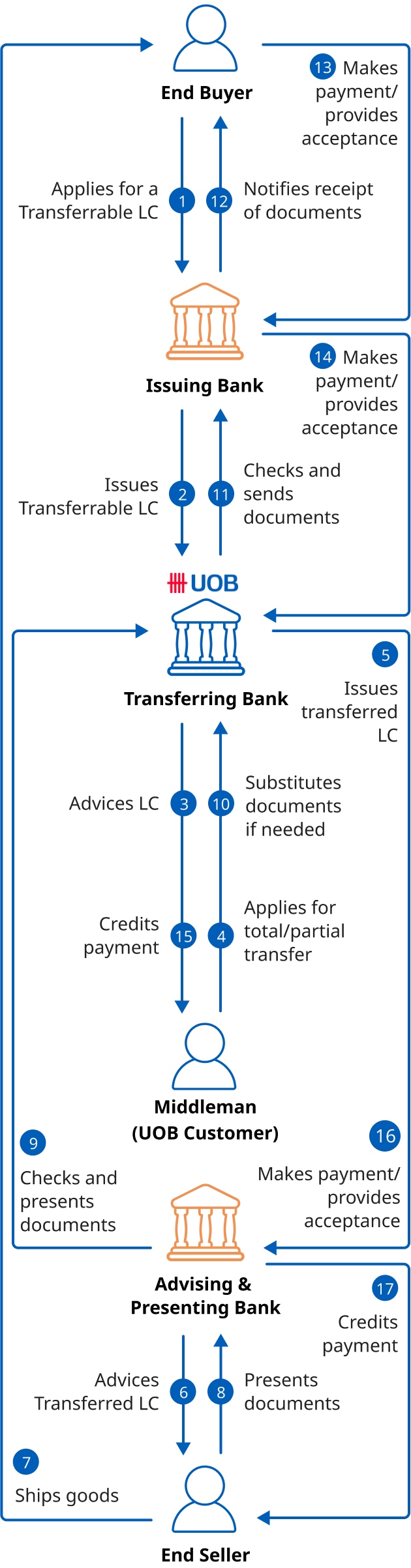

How does a Transferrable LC work?

Fees

For fees related to Trade Services, remittance fees and other service fees, please contact your nearest UOB China branch or you can call UOB China at 400 886 2821.

Click here to view Wholesale Banking Cash Management and Trade Finance Service Tariff.

Frequently asked questions

Which conditions can be revised in a Transferrable LC?

The LC can be transferred only in accordance with the terms and conditions stipulated in the original LC.

However, any or all of the below conditions may be reduced or brought earlier in the transferred credit to the second Beneficiary:

- The LC amount

- The unit price of goods

- The time of shipment

- The last date for presentation of documents

- The LC expiry date

The name of the Applicant can be substituted with the name of the first Beneficiary, unless the original LC stipulates that the name of the Applicant be used in any document other than the invoice. Instructions must also be provided on whether the bank is allowed to make any amendments to the original LC to the second Beneficiary.

What other specifications can be revised in a Transferrable LC?

If all or part of the LC is transferred, the first Beneficiary retains the right to substitute their own drafts and invoices for those of the second Beneficiary, if they so require.

Who bears the cost of transferring an LC?

LC Transferring fees are normally charged to the Beneficiary (Seller) unless otherwise agreed.