Economic Outlook

The economic cycle goes through four main phases of recovery, expansion, slowdown, and contraction. Of course, every economic cycle differs in terms of duration and scale and can be briefly distorted by unforeseen shocks. However, in general, the economic cycle follows a similar repeatable pattern of these four stages.

In the current economic cycle, we are now in the slowdown phase. Data over the past six months indicate a two-track global economy. On one hand, global manufacturing and trade have clearly slowed, while business sentiment has turned cautious. On the other hand, labour markets around the world remain strong. Coupled with a tourism surge, this has also benefitted the services sector.

These factors suggest that while economic growth is slowing, a recession is not yet imminent. Nonetheless, late-cycle weaknesses, such as concerns over the health of US regional banks, declining home sales and prices in many countries, as well as cracks in US commercial real estate, have become apparent.

Risks of a wider fallout from recent banking sector turmoil are expected to be contained by strong policy action after the failures of three US regional banks (Silicon Valley Bank, Signature Bank, and First Republic Bank) and the forced merger of UBS-Credit Suisse. However, it remains to be seen if financial conditions will tighten and dampen economic growth.

We also need to be mindful of the lagged effect of aggressive monetary policy tightening on the economy. New Zealand offers a cautionary tale, with their economy falling into a technical recession in 1Q 2023 after the Reserve Bank of New Zealand (RBNZ) delivered 525 basis points (bps) of policy tightening over the past 20 months. Bear in mind that the RBNZ was among the first central banks in the world to begin their rate hike cycle back in October 2021, while the US Federal Reserve (Fed) only started its rate hike cycle in March 2022. It is a matter of time that other economies will soon feel the lagged impact of policy tightening over the next six months. This could trigger potential issues such as a weakening of the labour market, deteriorating household balance sheets, and weaker consumption.

Another issue is the unresolved war in Ukraine which looks set to persist, and the potential for further conflict to spill onto the global economy in new ways.

While Developed Market (DM) economies are slated to gradually slow, Emerging Market (EM) economic growth is expected to outperform. We acknowledge that China’s economic recovery has been uneven so far, with exports and manufacturing activity slowing due to weakening global demand, while domestic consumption is supported by tourism and services spending. In the short-term, China’s economic growth may disappoint but the outlook is positive over a 24-month timeframe. One advantage China has is a sharp build-up of Chinese Yuan deposits. Once business and household sentiment improve, built-up Chinese Yuan deposits could result in a sharp ramp up in investment and spending.

The Chinese government is also clearly aware of growth risks and has started to support the economy with interest rate cuts. More targeted stimulus measures are also expected. We still see China’s 2023 GDP growth coming in at 5.6%, well above the International Monetary Fund’s (IMF) global growth forecast of 2.8% for this year.

Asia and ASEAN are expected to benefit once China’s economy starts to gain strength and global demand recovers to boost regional exports, with many regional central banks already starting to pause their rate hike cycles to support economic growth.

Inflation

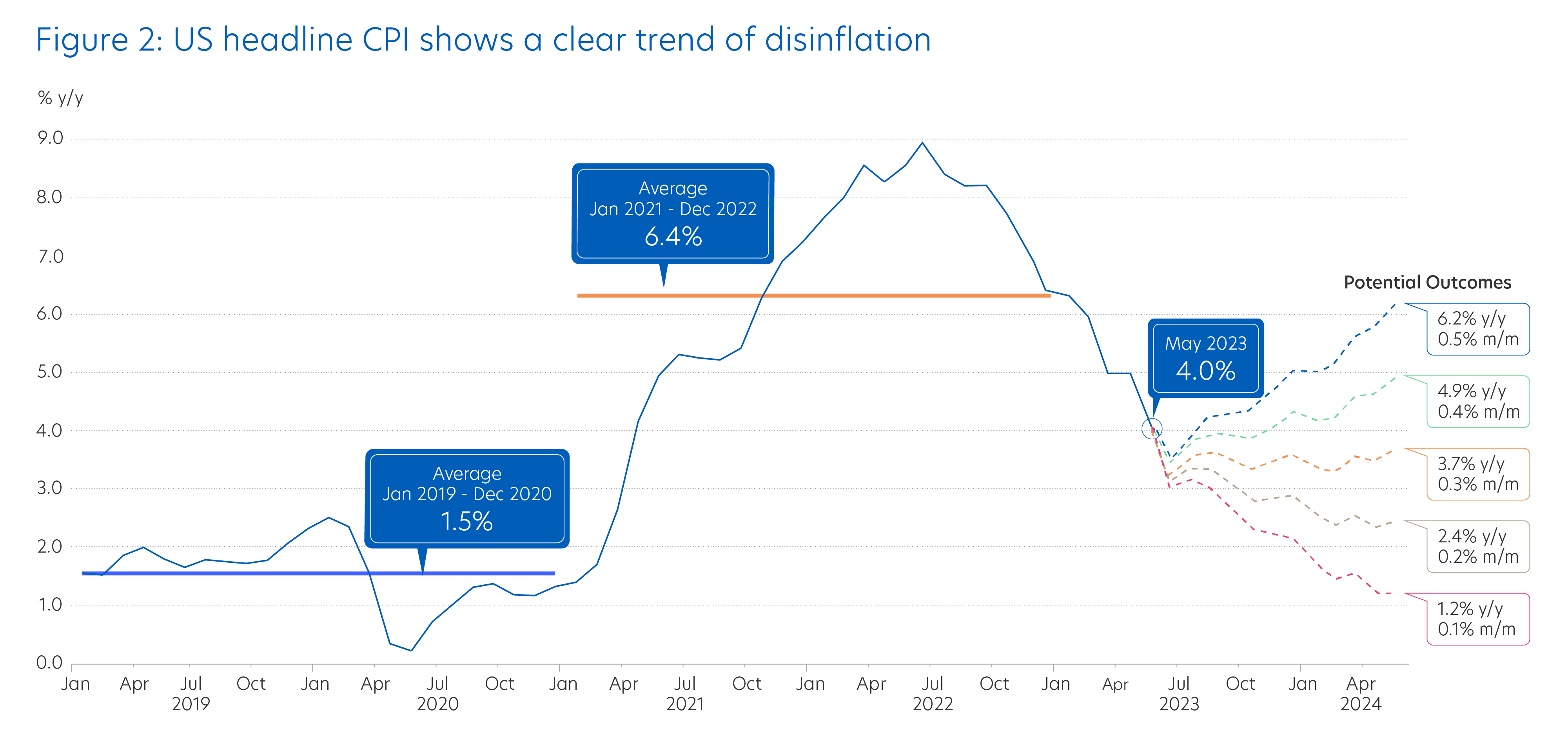

2023 kicked off with inflation as one of the big headwinds and unknowns. We now have more clarity on this front, and the prognosis is positive. While core inflation remains elevated, headline inflation has come down from its peak, showing a clear trend of disinflation. This is partly a result of high base effects when comparing on a year-on-year basis with 2022.

Looking at Figure 2, we map out the possible outcomes for year-on-year US headline consumer price index (CPI)![]() based on different month-on-month scenarios. If the month-on-month CPI figure stays at 0.2% consistently for the next 12 months, year-on-year headline CPI will fall to 2.4%. It is likely for disinflation

based on different month-on-month scenarios. If the month-on-month CPI figure stays at 0.2% consistently for the next 12 months, year-on-year headline CPI will fall to 2.4%. It is likely for disinflation![]() to continue into the middle of 2024.

to continue into the middle of 2024.

Source: UOB PFS Investment Strategists, Macrobond, and Bloomberg (30 June 2023).

While we need to keep a close eye on energy prices, fears have eased of a crude oil supply deficit for the rest of this year. Slowing economic growth also clouds the demand outlook, while transport-related inflation has begun to fall in many countries.

Goods prices have also trended lower though the path has been bumpy. While shelter costs, one of the key drivers of inflation, remain elevated, we are seeing encouraging signs that this is starting to ease.

With a slowing global economy set to curb consumption demand and ease labour market tightness, inflation is expected to come down.

Central Bank Policies

The slowdown phase of the economic cycle also means global monetary policy tightening is coming to an end. One good thing that came out of the recent banking sector turmoil is that any contraction in bank lending may partially negate the need for further monetary policy tightening.

On an optimistic note, the IMF feels that even though rates are high now from major central banks battling inflation, “when inflation is brought back under control, Developed Market central banks are likely to ease monetary policy and bring real interest rates back toward pre-pandemic levels”.

The IMF’s internal analysis also suggests that current high rates “are likely to be temporary”, and advanced economies will see interest rates fall back within sight of the “zero lower bound”.

A caveat needs to be added to the IMF outlook; no timeline on when interest rates revert to pre-COVID levels was provided. Rates may fall to lower levels in the coming years but a return to near-zero is unlikely on the immediate horizon.

Our view is that central bank policy rates will peak over the next six months but stay elevated. Rate cuts are likely only in 2024.

Asset Class Views

Equities

Global stock markets have largely performed better than expected over 1H 2023, defying downbeat expectations heading into the year. Better-than-expected economic data, robust labour markets, stronger-than-expected corporate earnings, along with AI-fever, created a “Goldilocks” situation where tech stocks rallied while volatility stayed low. The question now is whether this rally is sustainable, especially since the US Federal Reserve (Fed) is not expected to cut rates soon. With every economic cycle ending in a contraction phase, stocks will also be exposed to earnings risk.

Valid arguments support both bull and bear camps. Market fundamentals and dynamics show reason for global stock markets to move gradually higher in the short-term as a recession is delayed until 2024, but such a move could be choppy during this slowdown phase.

We retain a neutral outlook on US stocks. While corporate earnings have held up better than expected, slowing economic growth, lofty valuations, and the narrow breadth![]() of the recent stock market rally, are areas of concern. The market has also removed expectations of Fed rate cuts by year-end, and this may turn into a headwind for stocks when investors confront the reality of higher-for-longer interest rates. A renewed US banking shock, or a US commercial real estate crisis, could also trigger downside pressure for stocks.

of the recent stock market rally, are areas of concern. The market has also removed expectations of Fed rate cuts by year-end, and this may turn into a headwind for stocks when investors confront the reality of higher-for-longer interest rates. A renewed US banking shock, or a US commercial real estate crisis, could also trigger downside pressure for stocks.

On a positive note, if economic data surprises to the upside, this stock rally could continue. Another thing to highlight is that S&P 500 earnings per share (EPS) year-on-year growth, excluding the energy sector, has been declining since 2Q 2022, but the market thinks the earnings recession will end by 3Q this year and earnings growth will improve through 2Q 2024.

Source: UOB Private Bank, Macrobond, and US Federal Reserve (30 June 2023).

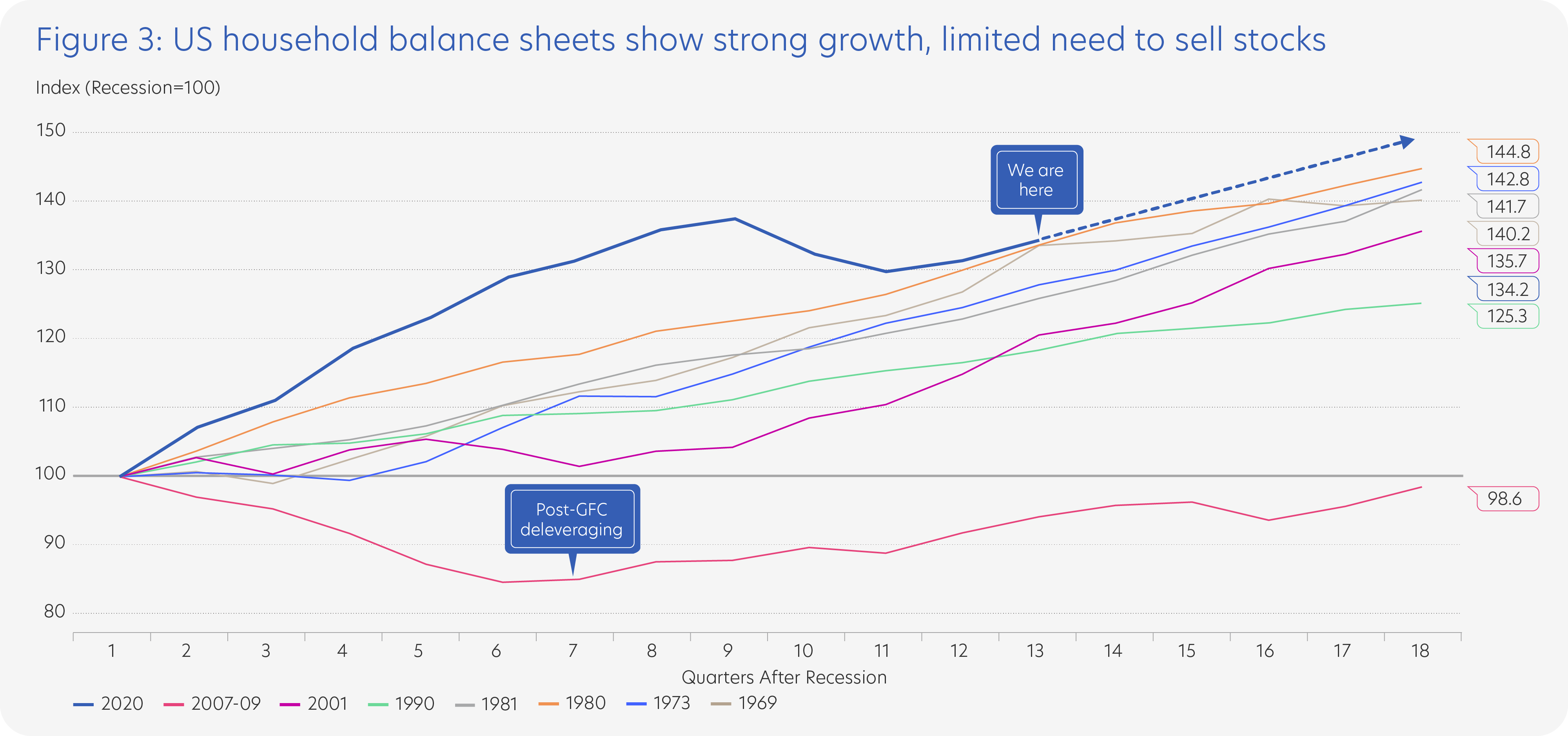

Figure 3 shows that investors in the US have no need to sell stocks even when the economy slows as US household balance sheets have grown sharply since the 2020 COVID-induced recession.

Encouragingly, the S&P 500 Index posted gains of 9.2% over the first 100 trading days of this year. History has shown that gains of 8.0% or more during this period typically lead to significant upside for the rest of the year.

Considering the above factors, the S&P 500 could end the year higher than current levels. Nonetheless, such a move is likely to be a slow grind higher rather than a sharp spike up, and interrupted by a short-term correction in the middle. Given such a potential scenario, it is prudent to maintain a diversified portfolio, be selective in investment choices, avoid concentration risks, and avoid chasing market rallies.

We retain an underweight allocation in European stocks. Risk of further European Central Bank (ECB) policy tightening is evident with European central bankers signalling “more ground to cover” on inflation.

In Asia ex-Japan, the short-term outlook is cautious as slowing export orders will weigh on regional manufacturers. That said, we retain a positive medium-term outlook out to 24 months as stock valuations are attractive. Regional inflation is also more benign, and some Asian central banks are one step ahead in the rate pause move. Coupled with robust domestic consumption, these are positive structural drivers.

Japan’s stock market has been a clear outperformer year-to-date. The TOPIX hit a 33-year high, driven by Warren Buffett increasing his stake in Japanese trading houses, foreign inflows, a slew of corporate share buybacks, low valuations, and a weakening Japanese Yen. Japan’s stock market has the tendency to be momentum-driven, meaning more upside cannot be ruled out. However, any unexpected shift by the Bank of Japan (BOJ) to tighten monetary policy could complicate things. We also need to keep an eye on the Japanese Yen, as the Japanese government may step in to support the currency to rein in imported inflation. BOJ intervention could remove one of the tailwinds for Japanese stocks.

Fixed Income

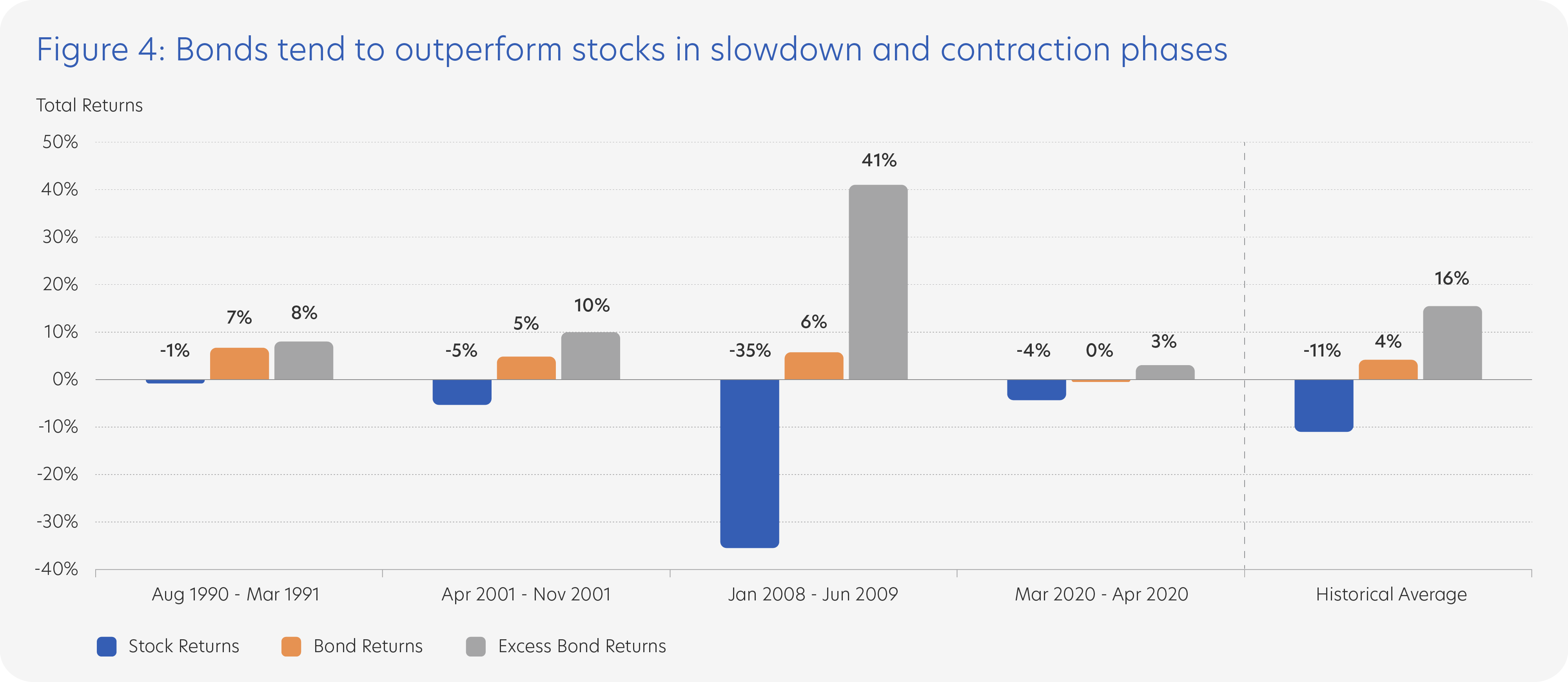

Bonds are in favour with yields near cyclical highs, monetary policy tightening nearing the end, and a slowing global economy. As seen in Figure 4, bonds tend to outperform stocks in both the slowdown and contraction phases.

Source: JPMorgan Asset Management. Stock returns based on MSCI ACWI Total Return Index.

Bond returns based on Bloomberg Global Aggregate Total Return Index (unhedged) (30 June 2023).

As the rate hike cycle nears the end and interest rates top out, locking in higher yields makes sense. We also want to emphasise that stronger asset quality will be important in an economic slowdown. We retain an overweight allocation in investment grade bonds, where investors can capture attractive yield without taking on unnecessary default risk.

Foreign Exchange and Commodities

Any short-term upwards push by the US Dollar (USD), will likely be a short-term countertrend. Instead, we expect the USD to drift lower into 2Q 2024 with the Fed policy tightening cycle almost over.

We retain a positive outlook on Gold as real interest rates will continue to decline amid heightened recessionary fears while the USD will weaken into 2024. Any geopolitical flareups will also provide a safe haven boost.

As for crude oil, there are downside risks to global demand as economic growth slows. Nonetheless, we are wary of the supply backdrop due to global sanctions against Russian sea-borne crude oil. In addition, Saudi Arabia has warned short-selling speculators to “watch out”, suggesting the possibility of more OPEC+ supply cuts. We expect oil prices to move upwards due to robust demand from Emerging Market countries, supply reduction due to OPEC+’s proactive output management, and a lack of infrastructure investments.

Country Focus

US

2023 2023 |

|

| GDP (y/y %) | 0.8% |

| CPI (y/y %) | 3.0% |

Equities

Potential earnings downgrades are a downside risk for the US stock market as the economy is slowing down and approaching the contraction phase. Focus on quality growth stocks and defensive sectors like Global Healthcare.

Fixed Income

10-year US Treasury yields could fall to 3.20% by end-2023 amid slowing economic growth, the trend of gradual disinflation, and higher safe haven demand.

Currency

The US dollar index (DXY) will be supported in the near-term as the US Federal Reserve (Fed) could deliver another one to two 25bps rate hikes, before weakening to 99.9 by end-2023.

Eurozone

2023 2023 |

|

| GDP (y/y %) | 0.1% |

| CPI (y/y %) | 5.5% |

Equities

European stock markets could continue to face headline risks, while valuations are likely to stay below their growth-oriented US peers. Stay cautious as recent data suggest a further growth slowdown ahead while the European Central Bank (ECB) has more tightening to do.

Fixed Income

The ECB will likely undertake its last interest rate hike of 0.25% by July and maintain the refinancing rate at 4.25% for the rest of 2023. However, if inflation refuses to slow materially, the ECB may raise rates beyond July.

Currency

With potentially more policy tightening ahead by the ECB as compared to the Fed, this may allow the Euro (EUR) to strengthen to 1.12 against the USD by end-2023.

Japan

2023 2023 |

|

| GDP (y/y %) | 1.0% |

| CPI (y/y %) | 3.5% |

Equities

Japanese stocks might see further upside as the market remains under-owned by global investors. The industrial sector could benefit from an expected pick up in industrial production from a low base. In addition, consumer discretionary stocks will be supported by strong wage gains.

Fixed Income

With the ongoing monetary policy review potentially lasting 12 to 18 months, the Bank of Japan (BOJ) could have a longer runway to unwind its ultra-loose monetary policy and is unlikely to abolish its yield curve control![]() (YCC) policy in the near-term.

(YCC) policy in the near-term.

Currency

With the BOJ unlikely to exit accommodative monetary policy for now, weakness in the Japanese Yen (JPY) may persist until 3Q before strengthening to 138 against the USD by end-2023.

China

2023 2023 |

|

| GDP (y/y %) | 5.6% |

| CPI (y/y %) | 0.8% |

Equities

Consumption-driven recovery in China should continue in 2H 2023, while earnings are expected to improve. The government is likely to keep a pro-growth stance given China’s low inflation. Chinese stock markets may continue to underperform global peers in the short-term. Geopolitical uncertainty remains, while Chinese Yuan (CNY) weakness will need to abate. In the medium-term, we retain a positive outlook on China’s economy and consumption.

Fixed Income

The People’s Bank of China’s (PBoC) accommodative policy stance remains supportive for Chinese bonds, but selection remains key. Investors should continue to favour quality investment grade bonds.

Currency

The recovery of the CNY is likely to be delayed until 4Q 2023 when China’s economy regains momentum toward end-2023. Nonetheless, look for the CNY to rebound to 7.10 against the USD by end-2023.

Singapore

2023 2023 |

|

| GDP (y/y %) | 0.7% |

| CPI (y/y %) | 5.0% |

Equities

The Singapore stock market is trading around fair valuation but watch for the risk of a significant slowdown in global trade and persistent inflationary pressures. Focus on stocks that could benefit from a recovery in China’s economy and the peaking of interest rates.

Fixed Income

Singapore bond yields are likely to stay lower than US bond yields until a shift in the monetary policy cycle. The 10-year Singapore government bond yield is likely to decline towards 2.70% by end-2023.

Currency

The impact of CNY weakness on the Singapore Dollar (SGD) could be limited due to the perceived status of SGD as a regional safe haven currency. The SGD is expected to reach 1.35 against the USD by end-2023.

Malaysia

2023 2023 |

|

| GDP (y/y %) | 4.4% |

| CPI (y/y %) | 2.8% |

Equities

The Malaysian stock market is likely to be supported by reasonable valuations as tourism-related sectors can recover further in 2H 2023. Risks persist from the global economic slowdown, tighter financial conditions, China’s uneven recovery, and upcoming state elections uncertainty.

Fixed Income

Bank Negara Malaysia (BNM) is expected to maintain interest rates at 3.00% due to manageable inflation expectations and resilient domestic growth prospect, which is favourable for the bond market.

Currency

The Malaysia Ringgit (MYR) may regain its strength at a slower pace due to CNY weakness, depressed oil prices, and upcoming state elections. The MYR is expected to reach 4.60 against the USD by end-2023.

Thailand

2023 2023 |

|

| GDP (y/y %) | 3.1% |

| CPI (y/y %) | 2.7% |

Equities

Valuations in the Thai stock market remain attractive, but ongoing downward earnings revisions will likely create a headwind for the market. Retail, healthcare, and tourism sectors could benefit once China’s consumption recovery accelerates.

Fixed Income

Bank of Thailand will likely keep its terminal rate at 2.00% for the rest of the year. Therefore, a flattening yield curve is expected to persist across 2023.

Currency

The Thai Baht (THB) has recently been weighed down by CNY weakness and weaker-than-expected Chinese tourist arrivals but could strengthen to 34.0 against the USD by end-2023.

Indonesia

2023 2023 |

|

| GDP (y/y %) | 5.0% |

| CPI (y/y %) | 3.8% |

Equities

Earnings growth, excluding the coal sector, is expected to remain healthy. The banking sector should continue to benefit from the economic recovery and steady loan growth, while the consumer sector should benefit from election campaign activities.

Fixed Income

Bank Indonesia (BI) is expected to maintain its benchmark rate at 5.75% for the rest of this year. The pausing of interest rate hikes and moderating inflation could drive inflows to the local bonds market.

Currency

While the Indonesian Rupiah (IDR) is expected to take direction from the CNY, ongoing implementation of foreign exchange operations through the placement of export receivables in the onshore market will anchor stability in the IDR. The IDR is expected to weaken to 15,200 in 3Q 2023 before strengthening to 14,800 against the USD by end-2023.

Economic Forecasts

Figure 5: Forecasts for 2023

| US | Eurozone | UK | Japan | Emerging Markets | Asia ex-Japan | China | India | Singapore | |

| 2023 GDP Growth Forecasts | +0.8% | +0.1% | +0.3% | +1.0% | +3.9% | +5.2% | +5.6% | +6.5% | +0.7% |

| 2024 GDP Growth Forecasts | +1.2% | +1.0% | +0.9% | +1.5% | +4.0% | +4.8% | +4.8% | +6.8% | +3.0% |

| Unemployment Rate Projections by the end of 2023 | 4.3% | 6.8% | 4.1% | 2.9% | 5.2% | 2.3% | |||

| 2023 Fiscal Balance Projections Note: Negative implies deficit |

-5.0% | -3.5% | -5.3% | -6.0% | -4.5% | -6.4% | -0.1% | ||

| 2023 Inflation Forecasts | +3.0% | +5.5% | +7.0% | +3.5% | +3.4% (Emerging Asia) +19.7% (Emerging Europe) +13.3% (Latin America) |

+0.8% | +5.3% | +5.0% | |

| 2023 Full-Year Earnings Growth Forecast (EPS) | S&P 500 | MSCI Europe | MSCI UK | MSCI Japan | MSCI Emerging Markets | MSCI Asia ex-Japan | MSCI China | MSCI India | MSCI Singapore |

| +10.4% | +5.0% | +1.6% | +5.1% | +18.6% | +21.5% | +15.2% | +17.3% | +3.9% | |

| Russell 2000 | EuroStoxx 600 | FTSE 100 | TOPIX | CSI 300 | Sensex | Straits Times Index | |||

| +25.7% | +5.7% | +2.0% | +5.4% | +15.4% | +17.8% | +2.6% | |||

| 1-Year Forward Price-Earnings Ratio (P/E) | S&P 500 | MSCI Europe | MSCI UK | MSCI Japan | MSCI Emerging Markets | MSCI Asia ex-Japan | MSCI China | MSCI India | MSCI Singapore |

| 19.4x | 12.8x | 10.3x | 14.9x | 12.1x | 12.8x | 10.0x | 20.7x | 11.5x | |

| Russell 2000 | EuroStoxx 600 | FTSE 100 | TOPIX | CSI 300 | Sensex | Straits Times Index | |||

| 23.5x | 12.6x | 10.5x | 14.6x | 11.2x | 19.5x | 10.4x |

Sources: UOB Global Economics and Markets Research (June 2023), Bloomberg (30 June 2023), and IMF World Economic Outlook (April 2023).

Credits

Credits

Managing Editor

- Winston Lim, CFA

Singapore and Regional Head,

Deposits and Wealth Management

Personal Financial Services

Editorial Team

- Abel Lim

Singapore Head,

Wealth Management

Advisory and Strategy - Michele Fong

Head, Wealth Advisory and Communications - Tan Jian Hui

Investment Strategist

Investment Strategy and Communications - Low Xian Li

Investment Strategist

Investment Strategy and Communications - Zack Tang

Investment Strategist

Investment Strategy and Communications - Nicholas Bryan Chia

Intern

UOB Personal Financial Services Investment Committee

- Singapore

- Abel Lim

- Ernest Low

- Michele Fong

- Tan Jian Hui

- Low Xian Li

- Zack Tang

- Jonathan Conley

- Alexandre Thoniel, CAIA

- Chen Xuan Wei, CFA

- Chia Hong Wei

- Daphne Chan

- Marcus Lee, CFTe, CMT

- Ivan Hu

-

Malaysia

- Ryan Tan

- Mow Wei Sern

- Thailand

- Suwiwan Hoysakul

- Boonnisaed Thanyaworaanan

- China

- Huang Li Li

- Indonesia

- Diendy

Important notice and disclaimers

The information contained herein is given on a general basis without obligation and is strictly for information purposes only. Such information is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing contained herein constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained herein, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained herein, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained herein.

Any opinions, projections and other forward looking statements contained herein regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.