What You Can do

At UOB, our Risk-First Approach serves as the foundation of wealth planning.

Protect your wealth with adequate cash buffers and appropriate insurance solutions. Then build wealth with a resilient portfolio of lower risk Core investments to meet long-term financial needs, before enhancing wealth with Tactical investments to capture market opportunities as they arise.

Market uncertainty and volatility could return as the global economy slows. As a recession is not yet imminent, global stock markets could move higher gradually albeit with bouts of volatility instead of in a straight line.

In such an environment, defensive portfolio allocation is advisable. Core investments can provide long-term income building opportunities that can weather different market cycles and volatility. They can also provide stable long-term returns and tend to be less volatile compared to more aggressive growth-oriented investments, providing a cushion during market downturns. Dollar-cost averaging can be a good way to build your Core investments to meet long-term financial goals.

Once the Core allocation has been built, you can consider Tactical investments to participate in any market upside. If you have sufficient risk appetite, consider our Top Ideas of Asia ex-Japan/China/ASEAN to play on the brighter medium-term economic outlook for the region, and Global Healthcare that is supported by a secular theme. In general, avoid chasing market rallies for Tactical investments and participate on corrections for the medium-term.

By balancing riskier investments with Core holdings, you can reduce downside risk to your portfolio and generate stable long-term returns.

To take advantage of higher rates, lock in higher yields now in investment grade bonds that can also protect during bouts of volatility.

Most importantly, build a diversified portfolio with an emphasis on risk management, and review it periodically with your goals in sight.

Core Allocation

Multi-asset Strategies

Being diversified and lower risk by nature, multi-asset strategies form a solid foundation in Core investments to help you build portfolio resilience and meet long-term financial goals.

With diversified asset allocation, multi-asset strategies can capture opportunities across different market cycles and asset classes such as stocks, bonds, and alternatives. Staying diversified can also reduce market volatility while providing long-term capital appreciation. Multi-asset strategies can also provide stable returns by investing globally across a variety of asset classes, potentially offering regular income in the form of monthly dividends.

While 2022 was a challenging year for multi-asset strategies, the situation appears brighter this year. The stock-bond correlation has turned negative. Even if this correlation turns positive again, the scenario could likely be one of rising stock and bond prices.

Therefore, accumulate multi-asset investments on dips for the long term.

Investment Grade Bonds

Lock in high yields from here as we are past peak inflation and the global monetary policy tightening cycle is nearing its end. Even more so, in longer duration bonds as there may not be an opportunity to grab such attractive coupons one or two years from here.

Bonds also tend to outperform stocks during the slowdown and recession phases, so you can take advantage of both higher yields and potential capital gains.

However, in an environment of slowing economic growth, asset quality is important, and we hold an overweight allocation in investment grade bonds for both Developed Markets (DM) and Emerging Markets (EM).

Tactical Allocation - Top Ideas

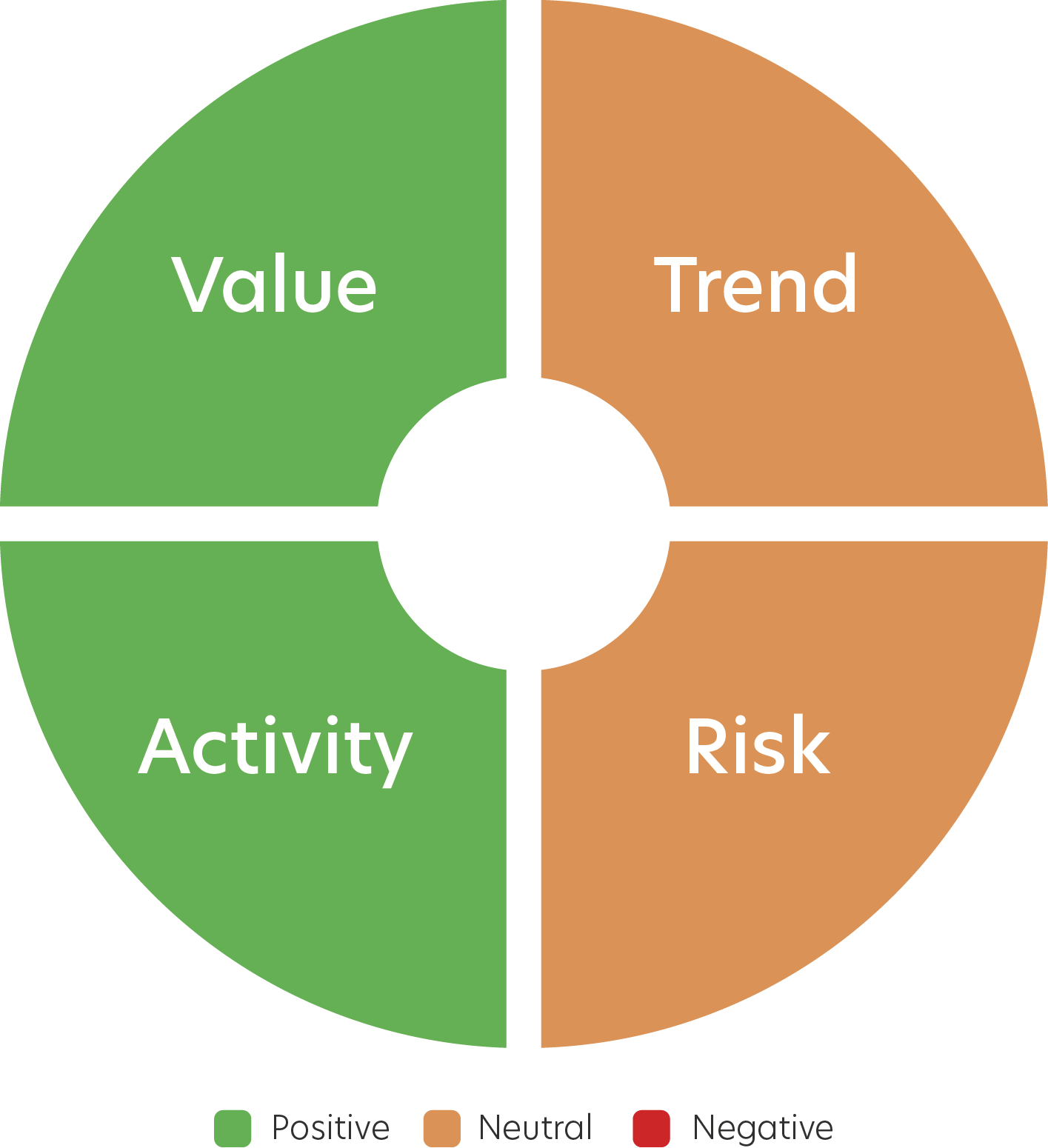

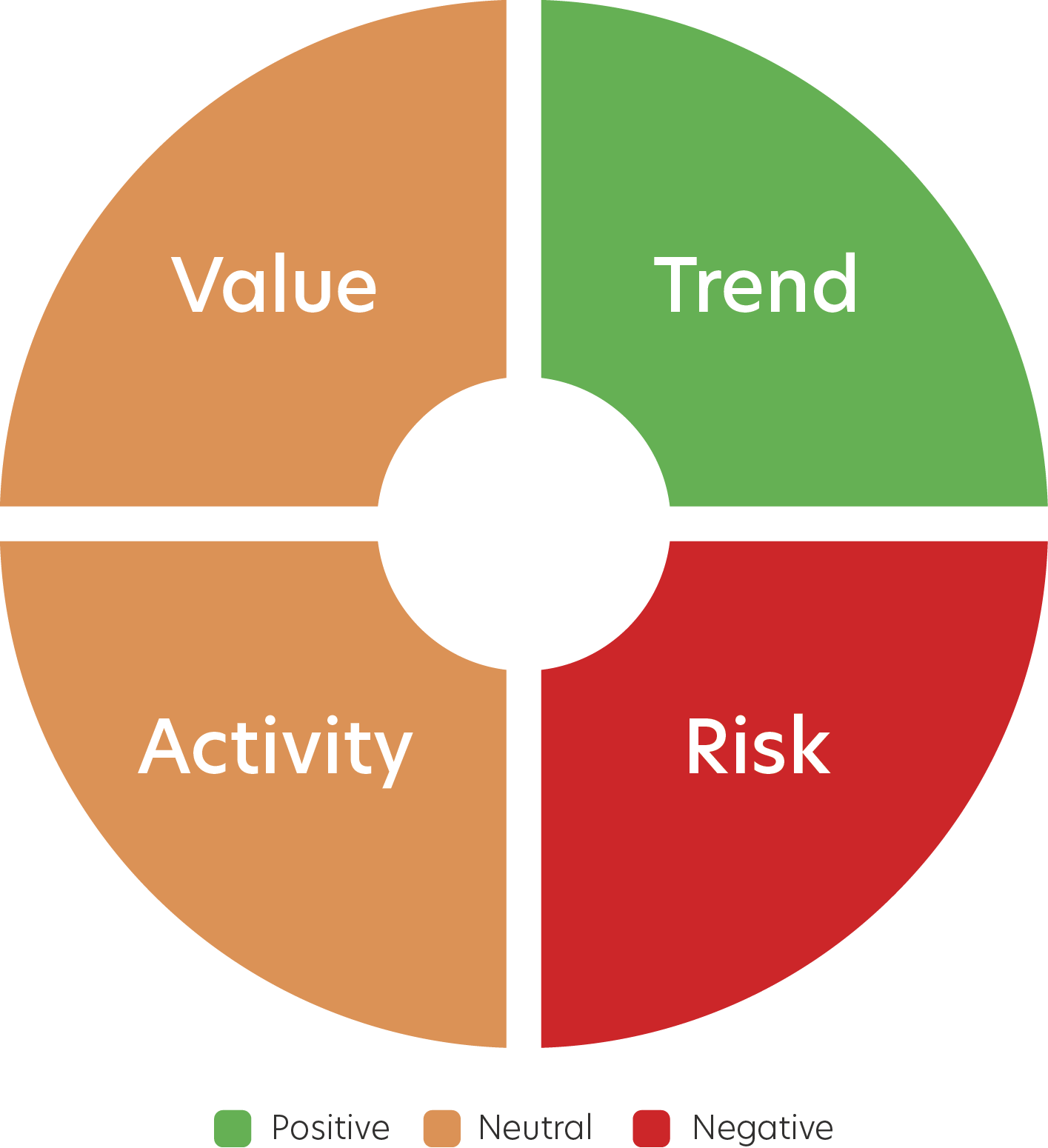

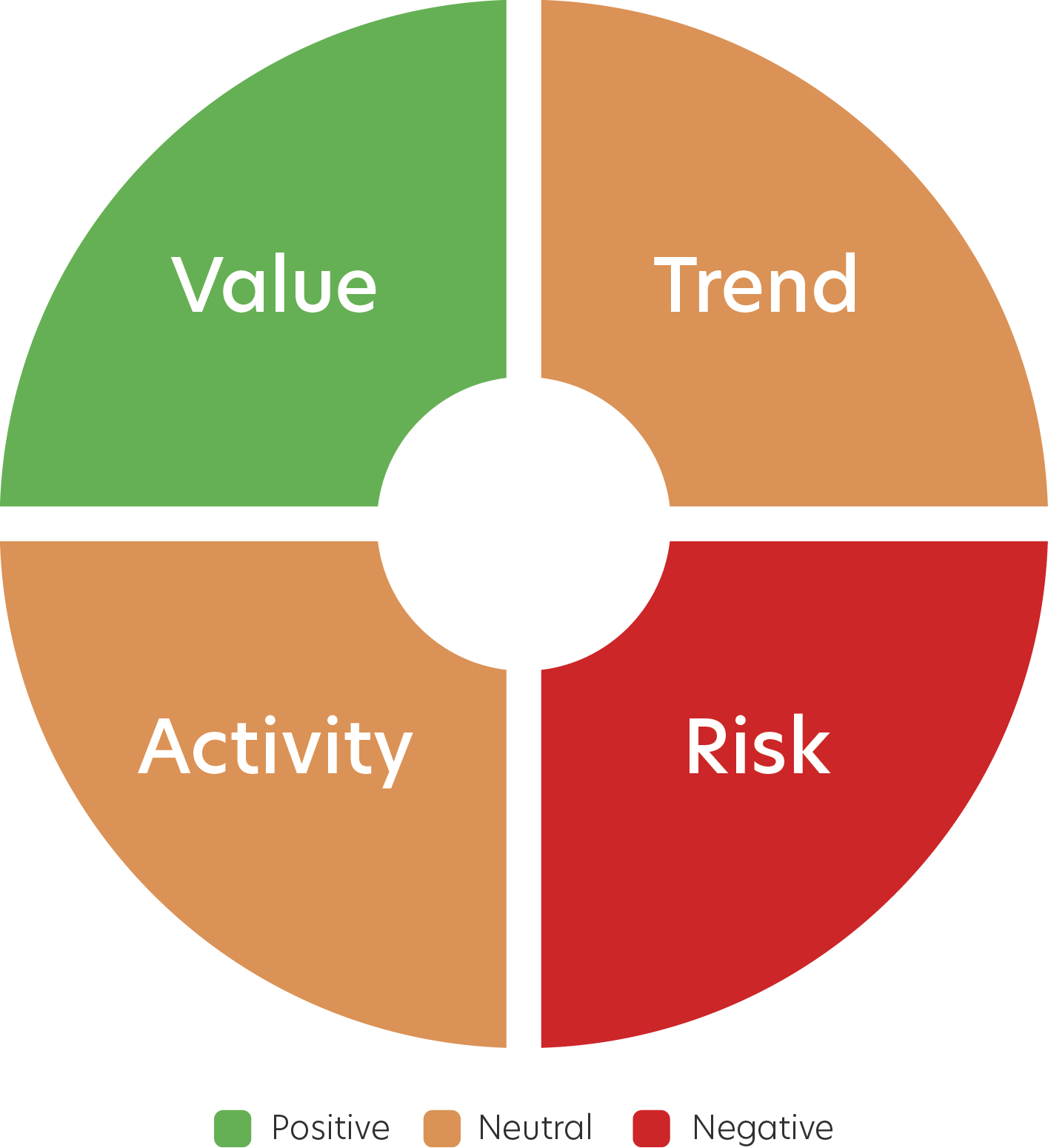

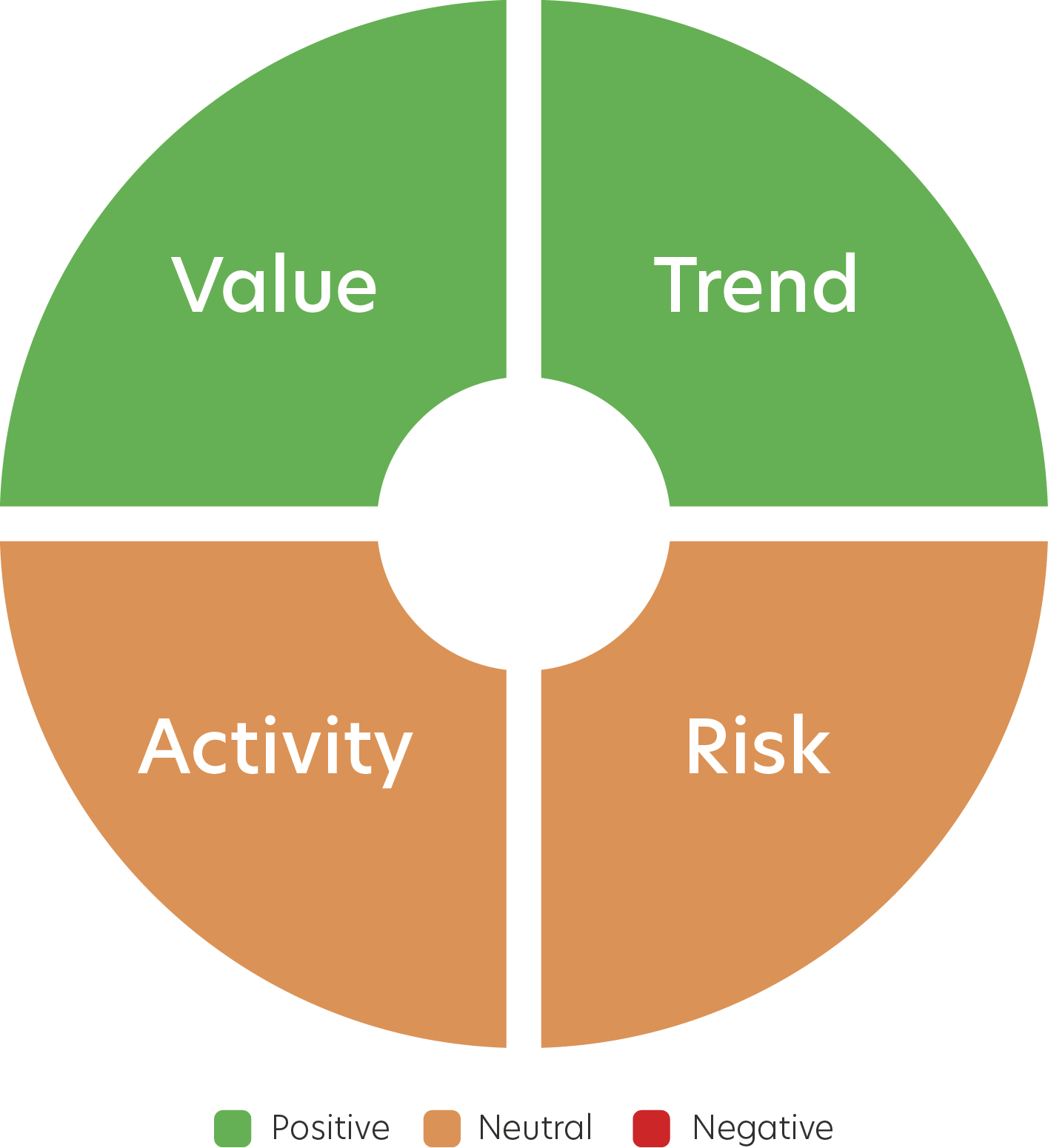

Top Ideas are investment opportunities, with a 24-month outlook, that the UOB Personal Financial Services Investment Committee identifies through a rigorous process of research and deliberation using our VTAR framework. This framework provides a holistic view of financial markets and identifies investment opportunities across asset classes, sectors, geographical regions, and time periods.

Asia ex-Japan/China/ASEAN

While we acknowledge short-term headwinds, we are positive on Asia ex-Japan/China/ASEAN for the longer run.

One common denominator in this Top Idea is China. While China’s economic recovery has been uneven so far, we retain a positive outlook over the medium-term. China’s growth is likely to outpace that of most other economies and should also support economic activity, via tourism or consumption, in the region.

Even though we are not seeing an explosive rebound in revenge spending that other DM economies saw post-COVID reopening, there is, nevertheless, a recovery trend. This gradual consumption recovery also bodes well as it is less likely to trigger an inflation shock, or export inflation to the rest of the world.

VTAR (China)

While Asian economies will not escape the reality of declining exports, they can still count on resilient regional consumption as a backstop.

VTAR (Asia ex-Japan)

ASEAN has three positive secular trends. First, as of February 2023, the UN estimates total ASEAN population at nearly 686 million, equivalent to around 8.6% of the global population. This is expected to grow to around 750 million by 2030.

Second, the region’s demographic is, at a median age of 30.2 years, relatively young. And lastly, ASEAN is also the sixth largest economic bloc in the world, with nominal GDP totalling USD 3.9 trillion and projected to grow to USD 6.6 trillion by 2030.

ASEAN’s inflation is far more benign than that of DM economies, and some ASEAN central banks have already started to pause their tightening cycle to focus on downside economic risks, far earlier than their DM counterparts.

VTAR (ASEAN)

Stocks in Asia ex-Japan and ASEAN also offer better value than those of DM peers, as seen by lower forward P/E ratios.

| Forward P/E Ratios | |||

| Current | Historical High | Historical Low | |

| ASEAN | 13.8x | 23.1x | 12.8x |

| Asia ex-Japan | 14.3x | 19.0x | 9.5x |

| EM | 13.3x | 18.6x | 8.5x |

| DM | 17.9x | 27.1x | 10.9x |

Source: Bloomberg (30 June 2023).

Despite short-term uncertainties, the medium-term outlook for Asia ex-Japan/China/ASEAN remains positive for those with risk appetite to tolerate near-term volatility.

Global Healthcare

Global Healthcare continues to be a compelling story.

Despite COVID-related health risks fading to the background, other infectious diseases still require healthcare resources. Furthermore, back in 2018, the World Health Organisation (WHO) warned of a future epidemic codenamed “Disease X”, and many government health agencies around the world are preparing by investing in healthcare research and infrastructure.

The global population continues to grow, particularly in developing countries. Population growth will place significant strain on healthcare systems, fuelling increasing demand for healthcare infrastructure and services.

Besides a growing population, the world also faces the secular trend of an ageing population. Amid an ageing demographic, healthcare needs increase, be it for long-term care, management of chronic ailments, or specialised geriatric care. This will require additional healthcare resources and innovation, which will deliver robust long-term earnings growth for the healthcare sector.

A rising middle class also brings along new patterns in non-communicable diseases, necessitating new healthcare solutions. An expanding middle class also leads to higher healthcare expectations and consumption.

Technological advancements have also started to transform the healthcare sector, and this trend will continue amid rapid innovations in artificial intelligence (AI), digital health, telemedicine, and genomics. The integration of new technology will help to not only improve quality of care, but also deliver higher efficiency and productivity for the healthcare sector.

During an economic slowdown and as we approach recession, those with risk appetite for exposure to stocks can consider participating in Global Healthcare given the industry’s defensive characteristics.

VTAR (Global Healthcare)

Credits

Credits

Managing Editor

- Winston Lim, CFA

Singapore and Regional Head,

Deposits and Wealth Management

Personal Financial Services

Editorial Team

- Abel Lim

Singapore Head,

Wealth Management

Advisory and Strategy - Michele Fong

Head, Wealth Advisory and Communications - Tan Jian Hui

Investment Strategist

Investment Strategy and Communications - Low Xian Li

Investment Strategist

Investment Strategy and Communications - Zack Tang

Investment Strategist

Investment Strategy and Communications - Nicholas Bryan Chia

Intern

UOB Personal Financial Services Investment Committee

- Singapore

- Abel Lim

- Ernest Low

- Michele Fong

- Tan Jian Hui

- Low Xian Li

- Zack Tang

- Jonathan Conley

- Alexandre Thoniel, CAIA

- Chen Xuan Wei, CFA

- Chia Hong Wei

- Daphne Chan

- Marcus Lee, CFTe, CMT

- Ivan Hu

-

Malaysia

- Ryan Tan

- Mow Wei Sern

- Thailand

- Suwiwan Hoysakul

- Boonnisaed Thanyaworaanan

- China

- Huang Li Li

- Indonesia

- Diendy

Important notice and disclaimers

The information contained herein is given on a general basis without obligation and is strictly for information purposes only. Such information is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing contained herein constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained herein, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained herein, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained herein.

Any opinions, projections and other forward looking statements contained herein regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.